The Complete FAFSA Guide: Your Roadmap to College Financial Aid

Hello, parents! As a college admissions counselor with over 23 years of experience helping families navigate the U.S. higher education system, I’m here to walk you through one of the most crucial steps in your child’s college journey: the FAFSA (Free Application for Federal Student Aid).

What Exactly is the FAFSA?

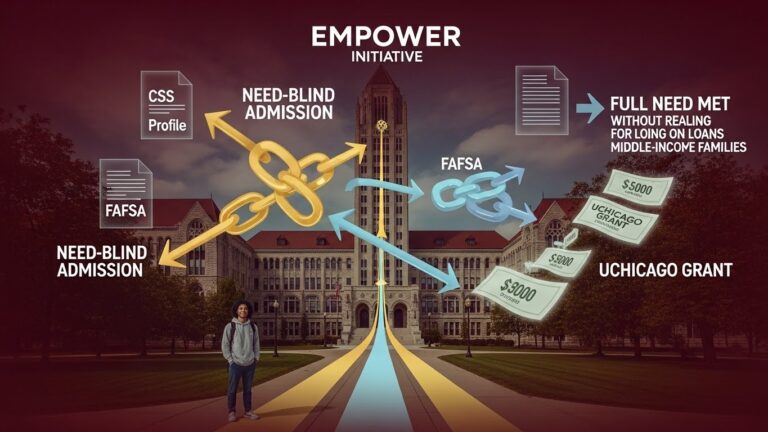

The FAFSA is your gateway to federal financial aid—a single, free application that opens doors to multiple funding opportunities. Through this one form, your student becomes eligible for federal grants (like the Pell Grant and FSEOG), federal student loans, and Federal Work-Study programs.

But here’s what many families don’t realize: the FAFSA isn’t just for federal aid. Most states and colleges use FAFSA data to determine their own financial aid packages too. That’s why I recommend every family complete the FAFSA, regardless of income level. You might be surprised by what’s available!

FAFSA Eligibility and Key Dates

Who Can Apply?

To be eligible for federal financial aid, students must:

- Be U.S. citizens or eligible non-citizens (permanent residents)

- Have a valid Social Security Number

- Have a high school diploma or GED (or be on track to graduate)

- Be enrolled or accepted in an eligible degree program

International students on F-1 or J-1 visas cannot apply for federal aid, though DACA recipients may qualify for state aid in some states—check your state’s specific policies.

Critical Dates to Remember

FAFSA Opens: October 1st each year Starting October 1, 2024, you can submit the 2025-26 FAFSA.

Federal Deadline: June 30th of the following year Don’t wait until then! Many aid programs operate on a first-come, first-served basis.

State Deadlines: Vary by state California’s deadline is March 2nd, while New York’s is June 30th. Check your state’s specific deadline—missing it could cost thousands in state grants.

College Deadlines: Vary by institution Early Action/Decision applicants typically face November deadlines, while Regular Decision applicants have until February or March.

Documents You’ll Need Before Starting

Gathering these documents beforehand will make the process much smoother:

Identity Documents

- Social Security cards for student and parent(s)

- Driver’s license or state-issued ID

- Alien Registration Card (if applicable)

Tax Information

- Tax returns from two years prior (2023 returns for 2025-26 FAFSA)

- W-2 forms and other income records

- Schedule C or K-1 for self-employed parents

- Foreign tax returns if you have overseas income

Asset Information

- Bank statements (checking and savings)

- Investment account statements (stocks, bonds, 529 plans)

- Real estate information (excluding primary residence)

Additional Documents

- Child support records for single parents

- Documentation of government benefits (SNAP, WIC, etc.)

Step-by-Step FAFSA Application Guide

Step 1: Create Your FSA ID

The FSA ID is your electronic signature for the FAFSA. Both student and parent need separate IDs, which you can create at StudentAid.gov.

Important FSA ID tips:

- Use your own information—never share IDs

- Use different email addresses for parent and student

- Write down usernames and passwords immediately

- While you can use it right away, full verification takes 1-3 days

Step 2: Access the Official FAFSA Website

Go to FAFSA.gov—make sure it ends in ‘.gov’. Beware of commercial sites that charge fees for what should be a free application!

Step 3: Start Your Application

Click “Start New Form” and log in with the student’s FSA ID. The 2024-25 FAFSA introduced a simplified form that’s much easier to complete than previous versions.

Step 4: Enter Student Information

Input the student’s basic information:

- Legal name (must match Social Security card exactly)

- Date of birth

- Social Security Number

- Marital status

- State of legal residence and date established

Step 5: Add Schools

Use Federal School Codes to add colleges. You can list up to 20 schools, and you can modify this list later. Include all schools your child is considering, even if they’re not certain about applying.

Step 6: Determine Dependency Status

Most undergraduates are considered dependent students. To be independent, a student must meet one of these criteria:

- Age 24 or older

- Married

- Graduate student

- Active military or veteran

- Have dependent children

- Were in foster care or ward of the court

- Homeless or at risk of homelessness

Step 7: Enter Parent Information (for Dependent Students)

Important 2024-25 change: Only one parent needs to be a “contributor” and provide information.

Who should be the contributor?

- Married parents living together: Either parent

- Divorced/separated parents: The parent who provided more financial support

- Remarried parent: Include stepparent’s information

Step 8: Input Tax Information

The Direct Data Exchange (DDX) feature pulls tax information directly from the IRS—I strongly recommend using this option for accuracy and convenience.

If you can’t use DDX, manually enter:

- Adjusted Gross Income (AGI)

- Income tax paid

- Education credits

- Untaxed income (IRA contributions, 401(k) deferrals, etc.)

Step 9: Report Assets

The 2024-25 FAFSA allows many families to skip asset reporting. If required, report:

- Cash, savings, and checking account balances

- Investments (stocks, bonds, 529 plans)

- Business assets (if employing 100+ people)

- Investment real estate

Assets NOT reported:

- Primary residence

- Retirement accounts (401(k), IRA, pensions)

- Life insurance cash value

- Personal possessions (cars, furniture)

Step 10: Sign and Submit

Review everything carefully, then sign electronically with FSA IDs. Dependent students need both their signature and a parent’s signature.

After You Submit

Student Aid Report (SAR)

Within 3-5 days, you’ll receive your SAR containing:

- A summary of all information provided

- Your Student Aid Index (SAI) (replaces the old EFC)

- Estimated federal aid eligibility

Review the SAR immediately for any errors.

Making Corrections

If you need to update information:

- Log back into FAFSA.gov

- Select “Make Corrections”

- Update necessary fields

- Re-sign and submit

Verification Process

About 30% of FAFSA applicants are randomly selected for verification. If selected:

- The college will request additional documentation

- Submit tax returns, W-2s, and verification worksheets promptly

- Delays in providing documents can delay your aid

Common Mistakes to Avoid

1. Waiting Too Long

Many aid programs are first-come, first-served. Submit as close to October 1st as possible.

2. Not Applying Due to High Income

Families earning $200,000+ can still qualify for aid, especially merit-based scholarships and low-interest loans. Always apply!

3. Using Wrong Tax Year

The 2025-26 FAFSA uses 2023 tax information. Remember the “prior-prior year” rule.

4. Name Mismatches

Names must match exactly across Social Security card, tax returns, and FAFSA. This is especially important if there’s been a recent marriage or name change.

5. Asset Reporting Errors

Report asset values as of the day you submit the FAFSA. Remember that 529 plans should be reported as parent assets.

Handling Special Circumstances

Recent Income Loss

Since FAFSA uses two-year-old tax data, recent job loss or income reduction won’t be reflected. Here’s what to do:

- Submit the FAFSA normally

- Contact each college’s financial aid office to request a “Professional Judgment” review

- Provide documentation of the income change

- The college may adjust your aid package accordingly

Parents Who Haven’t Filed Taxes

If parents had too little income to file taxes:

- Prepare an IRS Non-filer’s Statement

- Document all income sources

- Submit any additional forms the college requires

Uncooperative Parents

If you’re a dependent student and parents refuse to provide information:

- You won’t qualify for federal aid

- However, institutional aid may still be possible

- Contact the financial aid office to explain your situation

Understanding Your Financial Aid Award Letter

After submitting the FAFSA, each college will send an award letter containing:

Gift Aid (Free Money)

- Federal Pell Grant

- Federal SEOG

- Institutional grants/scholarships

- State grants

Work-Study

- Federal Work-Study opportunities

Loans

- Federal Direct Subsidized Loans (government pays interest while in school)

- Federal Direct Unsubsidized Loans (interest accrues immediately)

- Federal Direct PLUS Loans (parent loans)

Calculate each school’s net price (Total Cost – Gift Aid) to make informed decisions.

Final Thoughts

The FAFSA is your first and most important step toward making college affordable. While it may seem daunting, taking it step by step makes it completely manageable.

Billions of dollars in financial aid go unclaimed each year simply because families don’t complete the FAFSA. Don’t let your child miss out on these opportunities. Financial aid is available for families at all income levels—you just need to apply.

Remember, you’ll complete the FAFSA every year your child is in college. Keep good records from your first application to make subsequent years easier. Your child’s college education is one of the most important investments you’ll make, and the FAFSA helps ensure you get all the financial support available.

If you have questions, feel free to leave them in the comments below. Here’s to your family’s college success!

📧 Contact us

📞 470.253.1004

Andy Lee

Elite Prep Suwanee (powered by Elite Open School)

1291 Old Peachtree Rd, NW #127

Suwanee, GA 30024

📩 andy.lee@eliteprep.com

📺 YouTube: andyssamTV