Unlocking Duke: The Parent’s Essential Guide to Financial Aid & Affordability

Hello, Parents.

Today, I want to talk about Duke University—the pride of the South and an institution that rivals the Ivy League in both prestige and academic rigor.

I often hear parents say, “Duke is an incredible school, but there is no way we can afford it.”

If you have ever felt this way, I have good news. Duke operates under a powerful philosophy: “A student’s financial situation should never be a barrier to enrollment.”

In this guide, I will break down Duke’s financial aid policies, the critical paperwork you need to prepare, and real-world examples of what families actually pay. By the end of this article, I hope to turn your financial worries into a plan of action.

1. The Sticker Price vs. Reality

Let’s address the elephant in the room. If you look at the estimated Cost of Attendance for the 2024-2025 academic year, the numbers can be startling:

- Tuition: ~$66,000

- Room & Board: ~$19,000

- Books & Personal Expenses: ~$4,000–$5,000

- Total: ~$90,000 per year

Seeing a figure like $90,000 can be a shock. However, it is crucial to remember that this is just the “Sticker Price.” Just as few people pay the full Manufacturer’s Suggested Retail Price (MSRP) for a car, very few families pay the full sticker price for college.

At Duke, more than half of the undergraduate student body receives some form of financial assistance.

Admissions Policy: Need-Blind vs. Need-Aware

- For U.S. Citizens & Permanent Residents: Duke is Need-Blind. This means the admissions office does not look at your bank account when deciding whether to accept your child. Applying for financial aid will not hurt your child’s chances of getting in.

- For International Students: Duke is Need-Aware. For international applicants, requesting financial aid may impact the admissions decision, as the budget for international aid is limited. However, once admitted, Duke commits to meeting 100% of that student’s demonstrated need.

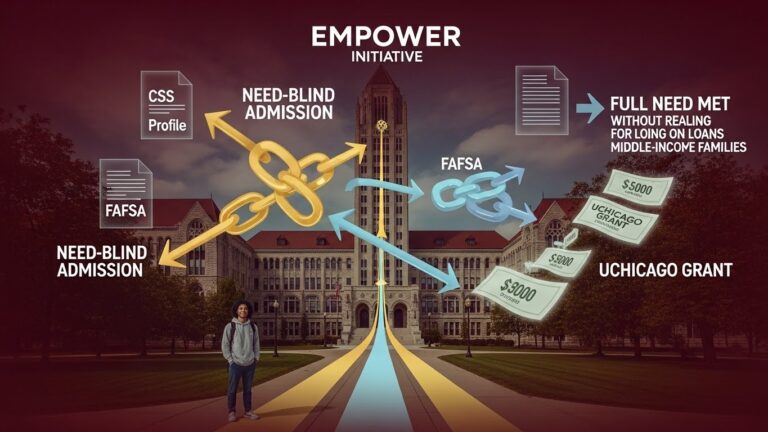

2. The Core Promise: “100% Demonstrated Need Met”

The cornerstone of Duke’s financial aid policy is their commitment to meeting 100% of your demonstrated financial need.

Simply put, if the university’s calculations show that your family cannot afford the full cost, Duke will cover the entire difference.

What is in a Financial Aid Package? Typically, an aid offer includes three components:

- Grants & Scholarships: This is “gift aid”—money that does not need to be repaid. This usually makes up the bulk of the package.

- Work-Study: A program that allows students to work part-time on campus to earn money for personal expenses.

- Student Loans: Duke is committed to minimizing debt.

- The <$60k Guarantee: For families with a total income below $60,000, Duke ensures no parent contribution and no student loans.

- Regional Benefits: Recently, Duke announced full tuition grants for students from North and South Carolina with family incomes below $150,000.

3. The Paperwork: What You Must Submit

To receive this funding, you must prove your financial need. Since Duke is a private institution, the documentation is thorough.

- FAFSA (Free Application for Federal Student Aid):

- Required for U.S. citizens and permanent residents.

- Determines eligibility for federal grants (like the Pell Grant) and federal loans.

- CSS Profile (College Scholarship Service Profile):

- This is the most critical form. It is used to award Duke’s own institutional funds.

- It provides a much deeper look into your finances than the FAFSA, asking about home equity, business assets, and non-custodial parent income.

- IDOC (Institutional Documentation Service):

- This is where you upload tax returns, W-2s, and other verifying documents.

⚠️ Deadline Alert: For Regular Decision applicants, the priority deadline is usually around February 1st. Mark your calendars—missing this date can jeopardize your aid package.

4. Need-Based vs. Merit-Based Aid

Here is where Duke differs slightly from the Ivy League.

- Need-Based Aid: This is where the majority of Duke’s funding goes. It is based strictly on your family’s finances, not your child’s grades.

- Merit-Based Scholarships: Unlike the Ivies, Duke does offer merit scholarships.

- Prestigious awards like the Robertson Scholars Leadership Program or the A.B. Duke Scholarship cover full costs based on merit.

- Note: These are incredibly competitive. It is best to plan based on need-based aid eligibility rather than banking on a merit scholarship.

5. Calculating Your “Net Price”

How much will you actually pay? Colleges calculate this using a formula:

Total Cost of Attendance – Student Aid Index (SAI) = Financial Need

If the total cost is $90,000 and your calculated family contribution is $20,000, Duke covers the remaining **$70,000**.

I highly recommend using the Net Price Calculator on Duke’s financial aid website. It takes about 15 minutes and gives you a personalized estimate of your costs.

6. Real-World Scenarios

Let’s look at three hypothetical families to see how this works in practice.

Case A: The Low-Income Family

- Profile: Family of 4, Income ~$55,000, minimal assets.

- Outcome: Duke covers tuition, room, and board fully.

- Parent Contribution: $0.

- Result: The student graduates debt-free, covering only personal expenses through a work-study job.

Case B: The Middle-Income Family

- Profile: Family of 4, Income ~$130,000, owns a home.

- Estimated Contribution: ~$15,000 – $20,000 per year.

- Outcome: Duke provides a grant of roughly $70,000+.

- Result: Attending Duke becomes comparable to—or even cheaper than—sending your child to an out-of-state public university.

Case C: The High-Income Family with Multiple Students

- Profile: Income ~$250,000, but with two children in college at the same time.

- Outcome: Duke’s formula accounts for the double tuition burden.

- Result: While they won’t get a full ride, this family might still qualify for $10,000–$20,000 in aid. Never assume you earn “too much” to qualify without checking first.

7. Counselor’s Core Advice

As you navigate this process, keep these four tips in mind:

- Ignore the Sticker Price. Duke has deep pockets for financial aid. Many middle-class families are surprised to find that Duke is more affordable than they imagined. If your child has the grades, apply first and look at the financial package later.

- Honesty is Key on the CSS Profile. Be transparent about your assets. Inconsistencies can lead to delays or penalties. Accuracy is your best policy.

- Strategy for International Families. If you are an international applicant, be strategic. Because admissions are Need-Aware, requesting aid makes getting in harder. However, if you cannot attend without aid, you must apply for it. Duke is one of the few schools that will fully fund you if you are accepted.

- It’s an Annual Process. You must reapply for aid every year. If your financial situation changes drastically (e.g., job loss or medical emergency), you can file an appeal with the Financial Aid Office. They are there to help, not to gatekeep.

Final Thoughts

Duke University is committed to building a diverse and talented community, and they put their money where their mouth is. Do not let the fear of a high price tag stop your child from applying to their dream school. With the right preparation and paperwork, a Duke education is within reach.

Thank you.

If you would like more detailed guidance on education planning, financial aid, or admissions strategy, please click here or contact us at: www.eliteprep.com/contact-us

We will provide personalized consulting and recommend tailored strategies that best fit your student’s individual needs.

Andy Lee / Elite Prep Suwanee powered by Elite Open School

1291 Old Peachtree Rd, NW #127

Suwanee, GA 30024

Elite Prep Suwanee Website

Elite Open High School Website

email: andy.lee@eliteprep.com

Tel & text: 470.253.1004

🎥 www.youtube.com/@andyssamTV