Is Cornell University Affordable? A Complete Financial Aid Guide for Parents

Hello! I am an educational consultant with 30 years of experience in college admissions and financial aid.

Today, I want to talk about Cornell University, an Ivy League institution beloved by many families for its practical approach to academics and its diverse campus culture.

Many of you dream of sending your child to an Ivy League school, but your heart might sink when you hear that the annual cost of attendance can exceed $90,000. It’s a staggering number. But please, don’t worry just yet. True to its founding motto, “Any person, any study,” Cornell operates a robust and systematic financial aid policy designed to ensure that economic circumstances never stand in the way of a student’s education.

In this guide, I will break down Cornell’s admissions and tuition overview, the key pillars of its financial aid policy (including Need-Blind vs. Need-Aware), application procedures and documents, estimated aid by income level, real-life case studies, and essential tips for parents. I’ll explain everything simply and clearly, so even a beginner can understand.

Let’s walk through the journey of making your child’s dream a reality, together.

1. Admissions Policy & Tuition Overview: “Expensive, but Generous”

First, let’s clarify how much Cornell actually costs and whether your financial situation affects your child’s chances of getting in.

1) Admissions Policy: Need-Blind for Domestic, Need-Aware for International Cornell’s policy differs based on the applicant’s residency status.

- U.S. Citizens / Permanent Residents / DACA Students: Cornell applies a Need-Blind policy. This means admissions officers do not look at your financial situation when reviewing applications. Put simply, “Applying for financial aid will not hurt your chances of admission.”

- International Students: Cornell applies a Need-Aware policy. This means your financial need is considered during the admissions process. Because the budget for international financial aid is limited, competition can be stiffer for international students who require significant financial support.

However, the most important takeaway is this: Once admitted, Cornell promises to meet 100% of your demonstrated financial need, regardless of your citizenship.

2) Tuition & Cost Breakdown (Estimated for 2025-2026) The Cost of Attendance (COA) at Cornell is undeniably high. Here is a rough breakdown:

- Tuition: ~$68,000 – $70,000

- Housing & Dining: ~$18,000 – $20,000

- Books, Supplies, Personal Expenses: ~$4,000 – $5,000

- Total Annual Cost: Approximately $90,000+

Looking at these numbers alone, you might think, “This is impossible for our family.” But remember, this is just the “Sticker Price.” The “Net Price”—what you actually pay after financial aid—can be significantly lower.

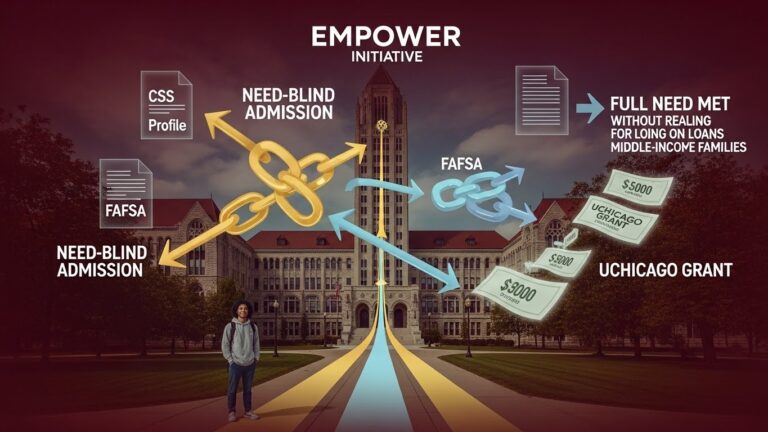

2. The Core of Cornell’s Financial Aid: 100% Need-Based

The principle behind Cornell’s financial aid is simple: “We fill the gap completely.”

1) No Merit-Based Scholarships Like all Ivy League schools, Cornell does not offer Merit Scholarships based on grades or athletic talent. Why? Because every student admitted to Cornell is already academically outstanding and talented.

Instead, all aid is strictly Need-Based. This isn’t “reward money for being smart”; it is “support money to ensure you can attend despite financial hardship.”

2) 100% Full Need Met The university calculates how much your family can afford to pay (your Expected Family Contribution, or EFC). Cornell then covers the entire remaining balance.

- The Formula: Total Cost ($90,000) – Parent Contribution ($20,000) = Financial Aid ($70,000)

3) Reducing Student Debt (Grant-Focused Aid) In the past, aid packages often included loans. However, in recent years, Cornell has aggressively moved to replace loans with Cornell Grants (free money you don’t pay back).

- Families earning under $60,000: Parent Contribution is $0 and no loans. (Full scholarship + Work-Study).

- Even for higher income brackets, Cornell works to limit or eliminate loans so students can graduate with little to no debt.

3. How to Apply: Documents & Deadlines

Even the best system won’t help if you don’t apply. Meticulous preparation is key.

1) Required Documents Applying for financial aid involves two main forms:

- CSS Profile: Run by the College Board, this is the standard form for private universities. Cornell uses this to take a microscopic look at your family’s income, assets, expenses, and debts to determine institutional aid. (Required for both domestic and international students).

- FAFSA: The Free Application for Federal Student Aid. This is for U.S. citizens and permanent residents to determine eligibility for federal aid (like Pell Grants).

- IDOC: A service for uploading supporting documents, such as tax returns and W-2 forms.

2) For International Students Since international students cannot file the FAFSA, the CSS Profile is the most critical document. You will need to submit translated versions of income proofs and tax records from your home country.

3) Deadlines – Crucial! Cornell is strict about deadlines.

- Early Decision: Financial aid forms are usually due around early November, alongside your admission application.

- Regular Decision: Forms are typically due by February 15th. (Always check the specific date on the website for the current year).

- Pro Tip: Submitting late can reduce the amount of grant money you receive. Aim to submit 1–2 weeks before the deadline.

4. Estimating Your Cost: How Much Will We Pay?

Many parents ask, “We earn about $100,000 a year. Can we still get aid?” The answer is, “Yes, you can receive a significant amount.”

1) How Expected Family Contribution (EFC) is Calculated Cornell doesn’t just look at your salary. They assess your overall “Financial Strength.”

- Income: Salary, business income, bonuses, etc.

- Assets: Savings, stocks, real estate (Cornell does consider home equity), business assets.

- Family Size: Number of dependents and, crucially, number of siblings in college. (Having two children in college at the same time drops your contribution significantly!)

2) Rough Guide by Income Level

- Income under $60,000: Parent Contribution $0. (Tuition, room, and board fully covered).

- Income $60,000 – $85,000: A small parent contribution is expected, but tuition is largely covered.

- Income $100,000 – $150,000 (Middle Class): You can expect a significant discount on tuition, potentially paying half or less of the sticker price.

- Income over $200,000: If you don’t have massive assets, or if you have multiple children in college, you may still qualify for some aid.

3) Net Price Calculator I strongly recommend visiting the Cornell website and using their Net Price Calculator. It takes about 5 minutes to input your data and get an estimate of your scholarship eligibility.

5. Case Studies: Real-World Examples

To help you visualize, let’s look at three hypothetical scenarios (based on 2025 figures).

[Case 1: The Frugal Middle-Class Family – The Kims]

- Situation: Annual income ~$90,000, family of 4, average assets (one home), first child admitted to Cornell.

- Result:

- Total Cost: $90,000

- Parent Contribution (EFC): ~$12,000 (Manageable with savings of ~$1,000/month)

- Student Contribution (Summer/Campus Job): ~$4,000

- Cornell Grant (Free Money): $74,000

- Takeaway: Out of a $90k bill, the parents pay only about $12k. This is comparable to, or sometimes cheaper than, sending a child to a private university in Korea.

[Case 2: High-Income Dual Earner Family – The Lees]

- Situation: Annual income ~$220,000, significant assets, but two children in college.

- Result:

- Normally, they might not qualify for much aid, but having two kids in college splits their assessed ability to pay.

- Cornell Grant: ~$30,000 aid.

- Parent Contribution: ~$60,000.

- Takeaway: Even with a high income, the “sibling factor” saved them roughly $30,000 a year. This is why you must apply.

[Case 3: International Family – The Parks]

- Situation: Living in Korea, Income ~$70,000, average assets. Admitted via Need-Aware process.

- Result:

- Being admitted means Cornell has committed to funding them.

- 100% Full Need Met (Same as U.S. students).

- Cornell Grant: Over $75,000 awarded.

- Takeaway: The admissions bar was higher, but once accepted, the financial burden was virtually eliminated.

6. Expert’s Tips for Parents

Based on my 30 years of experience, here are the key takeaways you should screenshot or write down.

- “Don’t be scared by the sticker price.” Cornell’s $90k price tag is just the retail price. Only about half of the students pay full price. The rest receive massive discounts based on their family circumstances.

- “If you are a U.S. citizen, ALWAYS apply.” (Need-Blind) Applying for aid does zero harm to your admissions chances. Not applying out of fear is a huge mistake that could cost you hundreds of thousands of dollars in debt later.

- “International students need a strategy.” (Need-Aware) For international students, applying for aid can affect admissions. If you can afford the tuition, it might be strategically better not to apply to increase your odds of acceptance. However, if you truly cannot afford it, apply boldly. It is better to be rejected than to be accepted and unable to attend.

- “Deadlines are non-negotiable.” If you are late, the system closes or funds run dry. Mark the FAFSA and CSS Profile deadlines in red on your calendar.

- “Look for outside scholarships.” If you receive scholarships from outside foundations, Cornell typically uses those funds to reduce your “Student Contribution” (work-study) or loans first. This allows your child to focus more on studying rather than working.

Conclusion: Cornell Supports Your Dreams

For over 150 years, Cornell University has upheld Ezra Cornell’s philosophy that “Any person” should be able to find instruction.

Do not close the door on your child’s potential because of money. Admissions officers want to select students based on their potential, not the thickness of their parents’ wallets.

The financial aid process can seem daunting and complex. But if you prepare carefully and knock on the door, Cornell’s deep pockets are ready to open for your child. I hope this guide helps relieve your anxiety and gives you hope.

Thank you.

For more detailed education and financial aid consulting: Elite Prep Suwanee

www.eliteprep.com/suwanee

We provide personalized strategies tailored to your child’s specific situation.

Andy Lee / Elite Prep Suwanee powered by Elite Open School

1291 Old Peachtree Rd, NW #127

Suwanee, GA 30024

Email: andy.lee@eliteprep.com Tel & text: 470.253.1004

🎥 www.youtube.com/@andyssamTV