Harvard University Financial Aid: A Complete Guide for Parents (2025–26)

Opening: Why Families Worry—and Why You May Not Need To

Harvard is one of the most prestigious institutions in the world, but its price tag can feel overwhelming. The annual cost of attendance—including tuition, housing, meals, books, fees, and personal expenses—runs around $90,000+ for 2025–26. Understandably, many parents ask, “Can we really afford Harvard?”

The encouraging news: Harvard’s financial aid is both generous and structured to ensure that talented students can attend regardless of family finances. This guide—written for Korean and Korean-American families both in the U.S. and abroad—walks you through admissions and costs, Harvard’s aid philosophy and paperwork, how need is calculated, parent tips, real-world examples, and key takeaways.

Admissions & Cost Overview

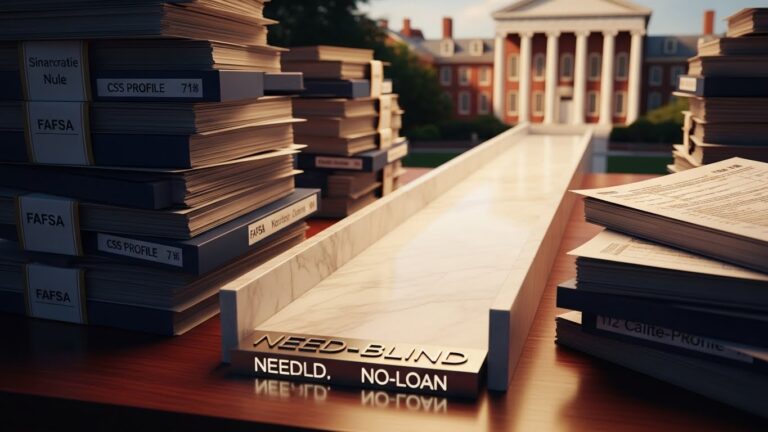

Need-Blind Admissions (including international students)

Harvard practices need-blind admissions—your decision to apply for aid has no impact on the admission outcome. Importantly, Harvard is one of the few universities that is need-blind for international students as well. Admission is highly competitive, but if your child is admitted, finances should not be the reason they say no.

Sticker Price vs. What Families Actually Pay

For 2025–26, Harvard’s sticker price is estimated at $90,426–$95,426 (tuition around $59,320; housing & dining around $22,130; plus fees, books, travel, and personal expenses). Prices tend to inch up annually, but few families actually pay the full sticker price because of need-based aid.

Harvard’s Aid Philosophy: Need-Blind Admission & 100% Need-Based Support

- Need-Blind Admissions

Students are admitted without regard to financial circumstances—for both U.S. and international applicants. - 100% Need-Based Aid

Harvard does not offer academic/merit or athletic scholarships at the undergraduate level. Instead, it meets 100% of demonstrated need for every admitted student—covering the gap between the cost of attendance and what the family can reasonably contribute.

What this looks like in practice

- Roughly 55% of Harvard undergraduates receive aid; their families pay an average of ~$15,700 per year out of pocket.

- About 25% of families pay nothing toward billed costs.

- Aid is primarily grant-based (not loans). Since the mid-2000s, Harvard has shifted to loan-free packages as a matter of policy.

- Harvard’s aid methodology does not count primary home equity or retirement assets when evaluating many families, easing the burden on typical middle-income households.

- The undergraduate aid budget for 2025–26 is reported at over $275 million.

Broad Support for Middle-Income Families

Beginning in 2025–26, families with annual income up to $100,000 can generally expect to pay nothing toward billed costs (tuition, housing, dining, and required fees). Families with income up to $200,000 often receive full tuition coverage and additional support toward room and board depending on circumstances. Even some higher-income families may qualify when there are multiple children in college or other special circumstances.

Bottom line: If your child is admitted, Harvard aims to make it financially possible for your family.

How to Apply for Aid (What to File & When)

Core Forms

- CSS Profile (required for all Harvard aid): A detailed application through the College Board capturing income, assets, and household context.

- IDOC (Institutional Documentation Service): After the CSS Profile, you’ll upload tax documents (e.g., IRS 1040s and W-2s for U.S. families; official income documentation for non-U.S. families). If your documents are in Korean, include a clear English translation (certified translation is not typically required, but accuracy is essential).

For U.S. Citizens/Permanent Residents

- FAFSA (in addition to CSS/IDOC): Determines eligibility for federal programs (e.g., Pell Grants, limited federal loans). Harvard then fills the remaining need with institutional grants.

International Students

- CSS + IDOC only (no FAFSA). Harvard covers full demonstrated need from institutional funds.

Deadlines (align with admissions rounds)

- Restrictive Early Action (REA): Typically Nov 1 for both admission and aid documents.

- Regular Decision (RD): Typically Feb 1.

Submitting on time ensures you receive your aid package alongside your admission decision.

Pro tip: Accuracy matters. Ensure amounts on CSS/IDOC match your tax forms. Late or inconsistent submissions may delay your package.

How Aid Is Calculated: From COA to Net Price

Harvard estimates a Parent Contribution (often called an EFC/parent share) using its institutional methodology—separate from the federal formula. The school evaluates income, assets, household size, number in college, and special circumstances, then meets the rest of the cost with grants.

Guiding Examples

- Family income ≤ $100,000: Parent share often $0; billed costs covered in full. Harvard has also indicated start-up grants (e.g., $2,000 for first-year transition needs).

- Family income $100,000–$200,000: Expect full tuition covered and additional grant aid toward housing/meal plans based on need. Many families contribute in the 0–10% of income range.

- Family income > $200,000: Aid eligibility depends on factors like multiple children in college, savings levels, and other financial realities—eligibility still possible.

What Assets Are Considered?

- Not typically counted: Primary home equity, retirement accounts.

- Counted: Cash/savings, non-retirement investments, second homes/investment properties, certain business/farm assets—reviewed case by case.

Student Contribution

Harvard expects a modest student contribution (e.g., from campus jobs). Since 2020–21, the summer earnings expectation has been waived. Students can also use outside scholarships to reduce their contribution; if scholarships exceed the student share, Harvard may adjust grants so total aid still meets, but does not exceed, demonstrated need.

Net Price Calculator

Use Harvard’s Net Price Calculator to estimate your family’s cost. It’s most accurate for U.S. citizens/PRs; international families can still use it for a directional estimate and then discuss details with the aid office.

Need-Based vs. Merit-Based Aid (and Why Harvard Doesn’t Offer Merit)

- Need-Based Aid: Based solely on family finances. This is Harvard’s model and the Ivy League standard.

- Merit-Based Aid: Awards for grades, test scores, athletics, arts, etc. Harvard does not offer merit scholarships to undergraduates. Admission itself is the recognition of merit; financial aid is based on need.

Outside scholarships are welcome and typically reduce the student’s expected work earnings first; any remaining excess may slightly adjust Harvard grants while keeping your net cost as low as possible.

Practical Tips for Parents

- “If admitted, don’t let cost be the barrier.” Harvard meets full need—apply for aid without fear of hurting admissions chances.

- Meet the deadlines (REA around Nov 1; RD around Feb 1) and double-check accuracy of all figures and documents.

- International families: Gather official income documents early and provide clear English translations with USD conversions where helpful.

- Use the Net Price Calculator to get a rough sense of what you’ll pay. Treat it as an estimate, not a guarantee.

- Plan for incidentals (personal expenses, occasional travel, laptop). Very low-income students may receive additional help; otherwise, light campus work or outside scholarships can cover these items.

- Share special circumstances. If your family has unique financial challenges (business loss, medical bills, currency issues, assets that are not readily usable), tell the aid office. Harvard will review appeals and documentation.

- Report outside scholarships promptly so Harvard can coordinate them into your package.

- Reapply annually. Aid is recalculated each year and can go up or down with changes in income, assets, or number in college.

Two Example Scenarios (Illustrative)

Case 1: Lower-Income Family Abroad

A student admitted from Korea with family income around $40,000 applied for aid. Harvard covered tuition, housing, meals, and fees entirely with grants. The student also received a first-year start-up grant to help with travel and settling expenses. Minimal work expectations ensured academics came first.

Case 2: U.S. Middle-Income Family

A student from a U.S. Korean-American family with $150,000 income and a second child in high school received $60,000+ in grants—bringing the net cost down to roughly $30,000. When the younger sibling entered college, Harvard increased aid further, reducing the family share.

Conclusion: Balance the Dream with a Real Plan

Yes—Harvard is expensive on paper. But it’s also one of the most generous universities in terms of need-based aid. The school’s stance is clear: bring the best students, and we’ll make it financially possible. If your child is competitive for admission, don’t self-select out because of cost fears.

Learn the process, submit accurate documents on time, and communicate special circumstances. With Harvard’s commitment to meeting full need, most families find the net price far more manageable than they expected.

Contact (for your local counseling services)

If you’d like personalized guidance on Harvard and other selective colleges: www.eliteprep.com/contact-us

Andy Lee / Elite Prep Suwanee (powered by Elite Open School)

1291 Old Peachtree Rd, NW #127, Suwanee, GA 30024

Phone/Text: 470.253.1004

Email: andy.lee@eliteprep.com

YouTube: youtube.com/@andyssamTV

Website: Elite Prep Suwanee Website