The Ultimate Guide to Financial Aid at Brown University for Parents

Dear Parents,

Today, we will take a deep dive into the financial aid policies of Brown University, one of the most prestigious institutions in the Ivy League. Brown is renowned not only for its exceptional “Open Curriculum” but also for its powerful financial aid philosophy: ensuring that a student’s economic background is never a barrier to a world-class education.

As an expert who has guided families through this process for decades, I will walk you through the core principles and details you need to know to navigate Brown’s financial aid landscape.

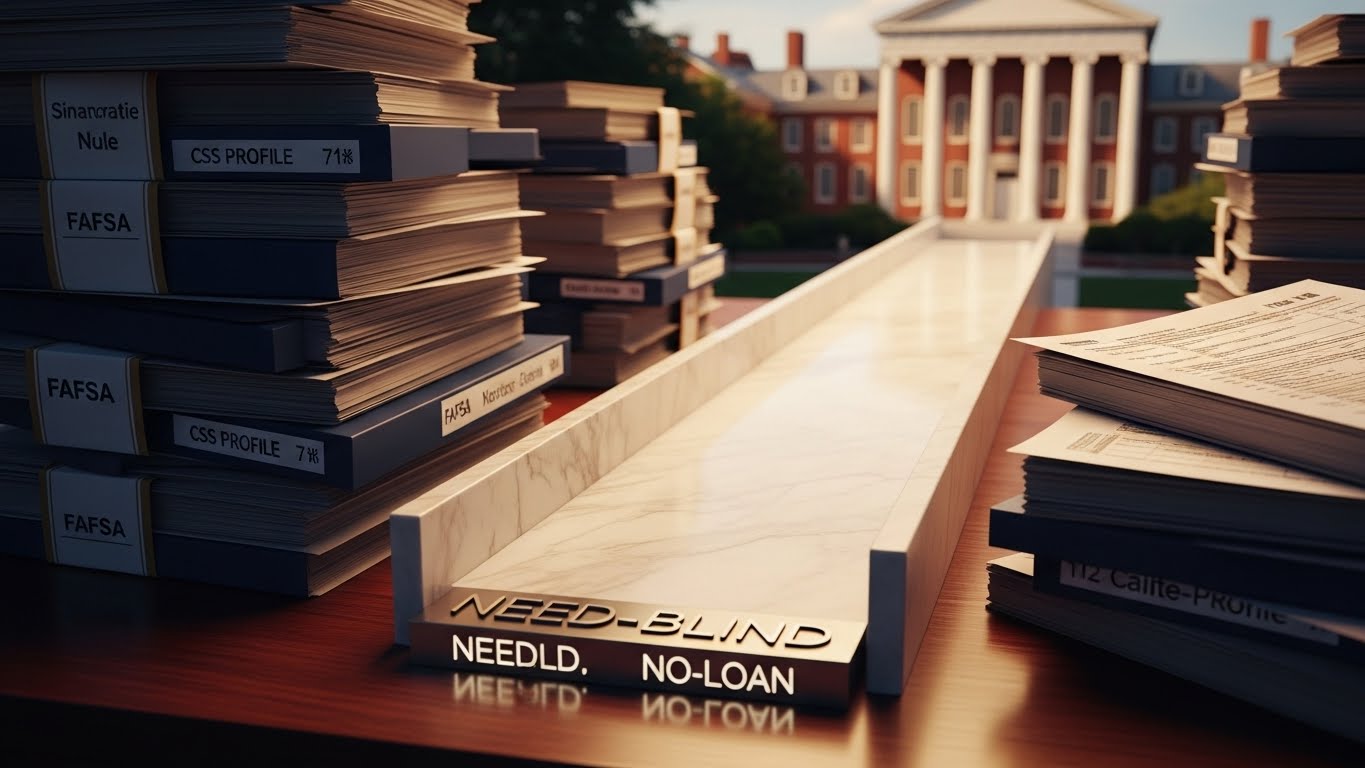

1. The Foundation: A “Need-Blind” Admission Policy

The most critical principle for parents to understand regarding Brown’s admission process is the Need-Blind policy.

- What Need-Blind Means: Simply put, Brown decides whether to admit a student based entirely on their academic excellence, potential, and character—without ever looking at their ability to pay tuition.

- Who it Covers: This policy applies to U.S. citizens, permanent residents, and undocumented students (including DACA recipients). When your child submits their application, the admissions officers have no access to information regarding whether the student applied for aid or how much the family can afford.

Expert Insight: In my thirty years of consulting, I’ve seen many parents worry that requesting aid will hurt their child’s chances. At a robust Need-Blind institution like Brown, you can set those fears aside. The university focuses on talent first; financial status only enters the conversation after a student has been admitted.

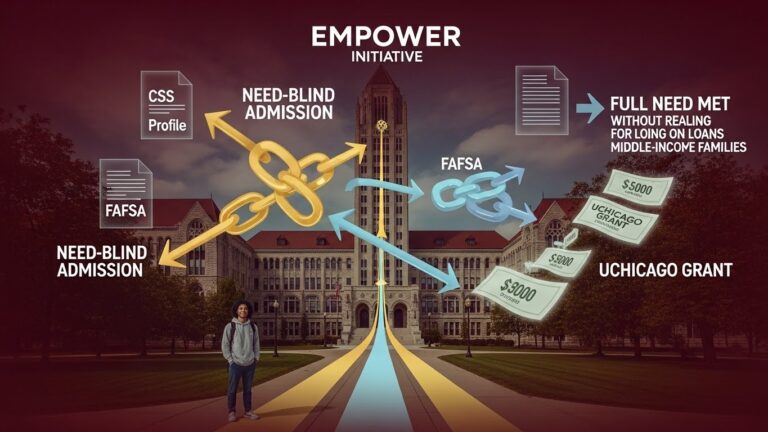

2. The Promise: Meeting 100% of Demonstrated Need

Brown goes a step further than just “blind” admissions; they pledge to meet 100% of a student’s demonstrated financial need.

- The Formula: $$\text{Demonstrated Need} = \text{Cost of Attendance (CoA)} – \text{Expected Family Contribution (EFC)}$$

- Cost of Attendance (CoA): This is not just tuition. It includes fees, housing, meals (Room and Board), health insurance, books, personal expenses, and travel. Currently, Brown’s total CoA sits between $93,000 and $95,000 per year.

- Expected Family Contribution (EFC): This is calculated using the FAFSA and the CSS Profile. It considers income, assets, family size, and the number of children in college to determine a fair amount the family can contribute.

Brown is known for being “parent-friendly” when calculating EFC, often showing flexibility regarding retirement savings and home equity compared to other elite institutions.

3. The “No-Loan” Policy: A Debt-Free Future

Perhaps the most life-changing aspect of Brown’s financial aid is the The Brown Promise, launched in 2018. Brown has eliminated packaged loans from its financial aid awards.

Instead of loans that must be repaid, Brown provides Gift Aid:

- Brown University Scholarships: The largest portion of the package, funded by the university’s endowment. This does not need to be repaid.

- Federal & State Grants: Such as the Pell Grant, which also does not require repayment.

- Federal Work-Study: An optional opportunity for students to work part-time on campus to cover personal “pocket money” expenses.

Because of this “No-Loan” policy, students can graduate and enter the workforce or graduate school without the burden of student debt.

4. The Application Process: Required Documents

Securing this aid requires a meticulous and timely application. You will generally need to submit:

- FAFSA: Used to determine eligibility for federal aid.

- CSS Profile: A more in-depth look at your family’s finances used by private universities to award their own institutional funds.

- Tax Returns & W-2s: Submitted via the IDOC (Institutional Documentation Service) to verify the information provided in your applications.

- Non-Custodial Parent Info: If parents are divorced or separated, Brown typically requires financial information from both parents, though waivers are available for specific circumstances.

Crucial Note: Deadlines are non-negotiable. Submitting your financial aid documents alongside your admission application ensures you receive your aid package at the same time as your acceptance letter.

5. International Students: The “Need-Aware” Reality

It is important to note that for international students, Brown currently operates on a Need-Aware basis.

- Need-Aware Definition: For international applicants, the university does consider a family’s ability to pay when making admission decisions. Because the budget for international aid is finite, applying for aid can make the already competitive admission process even more challenging.

- The Silver Lining: If an international student is admitted, Brown still guarantees to meet 100% of their demonstrated need and applies the same No-Loan policy.

6. Special Circumstances and Appeals

Life is unpredictable. If your financial situation changes after you submit your application, Brown provides a process for Re-evaluation (Appeal).

Valid reasons for an appeal include:

- Sudden job loss or significant income reduction.

- Unusually high out-of-pocket medical expenses.

- Financial impact from a natural disaster.

Brown’s financial aid officers are known for being professional and empathetic. If your EFC does not reflect your current reality, do not hesitate to provide documentation and request a review.

Conclusion: The Value of a Brown Education

Brown University is committed to the idea that the “best and brightest” should not be limited by their bank accounts. By offering Need-Blind admissions, 100% need fulfillment, and a No-Loan policy, Brown ensures that students can focus entirely on their intellectual growth rather than financial stress.

If you are considering Brown for your child, do not let the “sticker price” deter you. The university is ready to invest in your child’s future.

Thank you.

Andy Lee / Elite Prep Suwanee

- Web: www.eliteprep.com/suwanee

- Tel: 470.253.1004

- Email: andy.lee@eliteprep.com

- YouTube: @andyssamTV

- Address: 1291 Old Peachtree Rd, NW #127, Suwanee GA, 30024