A Comprehensive Guide to Financial Aid at the University of Chicago for Parents

It has long been my calling to provide parents with clear, reliable information during what can often be a complex and overwhelming process.

Today, we focus on the University of Chicago (UChicago), an institution world-renowned for its rigorous academic standards. I understand that for many parents, the concern over financial burden is just as significant as the excitement of a potential admission. In this guide, I will break down UChicago’s financial aid philosophy, its structure, and the essential information every family needs to know.

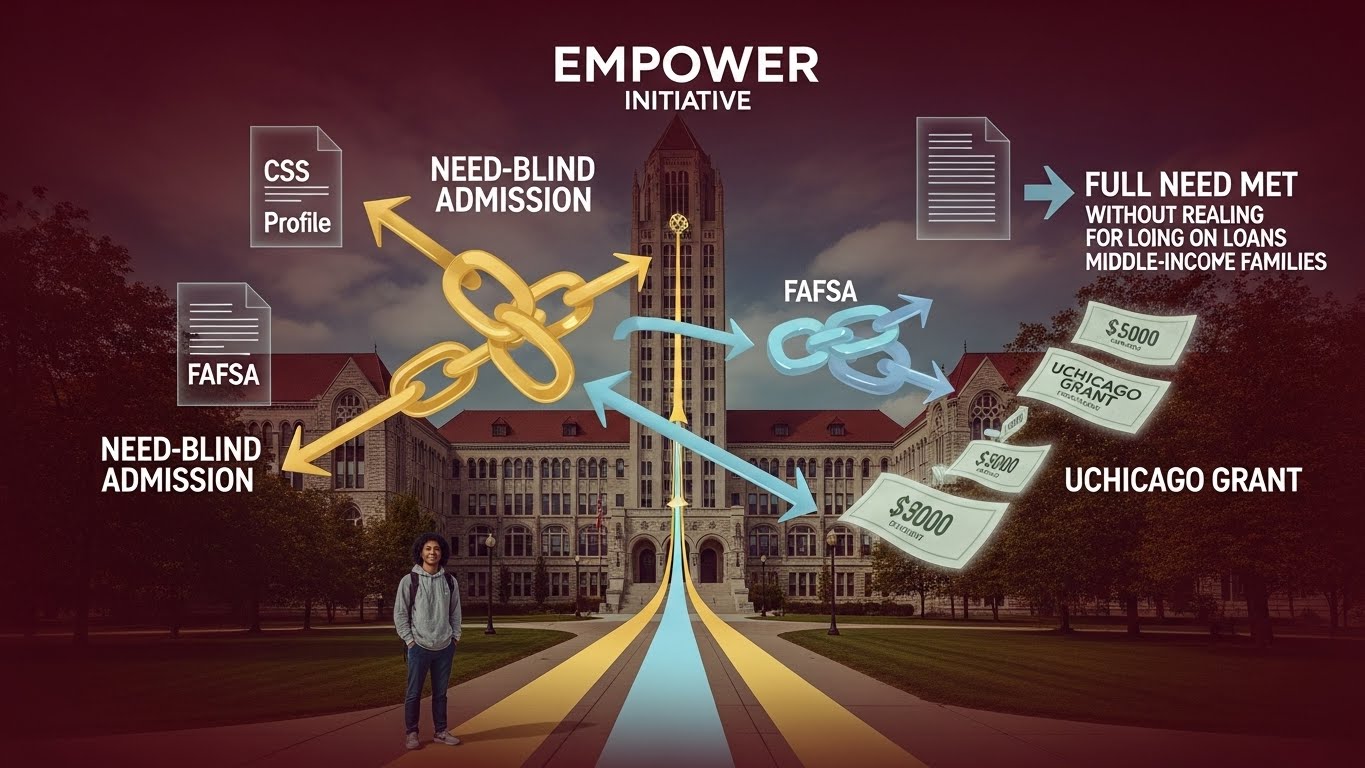

I. The Core Philosophy: The Empower Initiative

Since 2018, the University of Chicago has operated under a landmark financial aid policy known as the Empower Initiative. This initiative is built upon two bedrock principles that demonstrate the university’s commitment to accessibility.

1. A Firm Commitment to Need-Blind Admissions

This is the most critical point for parents to understand: UChicago practices a Need-Blind Admission policy for all domestic freshman applicants.

What does “Need-Blind” mean? It means that the admissions committee reviews applications without any knowledge of a student’s financial situation. Whether or not you apply for financial aid—or how much aid you might need—has zero impact on the admission decision. UChicago focuses solely on a student’s academic potential, intellectual curiosity, and their ability to contribute to the campus community.

2. Guaranteeing 100% of Demonstrated Financial Need

UChicago officially pledges to meet 100% of a student’s demonstrated financial need. To understand how this is calculated, we look at three key concepts:

- Cost of Attendance (COA): This includes tuition, room and board, books, personal expenses, and travel costs. UChicago uses a very realistic figure to estimate the total cost of one year on campus.

- Student Aid Index (SAI) / Expected Family Contribution (EFC): Based on your income, assets, and family size, the university calculates what your family can reasonably contribute toward education.

- Financial Need: This is the difference between the two.

Financial Need = Cost of Attendance (COA) – Family Contribution (SAI/EFC)

UChicago covers this entire “Financial Need” gap using a combination of grants and work-study opportunities.

II. Key Features: Expanding the “No-Loan” Policy

The most powerful aspect of UChicago’s financial aid is its commitment to minimizing or completely eliminating student loans.

1. The Role of the UChicago Grant

Most financial aid at UChicago is provided through the UChicago Grant, which is “gift aid” that does not need to be repaid.

- For Families Earning Under $125,000: For families with typical assets and an annual income under $125,000, UChicago ensures that the financial aid package contains no loans. The entire need is met through grants and work-study.

- Full Tuition for Families Under $60,000: For families with typical assets earning less than $60,000 per year, UChicago provides grants that cover the full cost of tuition.

2. Federal Work-Study

Packages often include a work-study component, typically ranging from $2,000 to $3,000 per year. This allows students to earn money through part-time jobs on campus (in libraries, labs, or administrative offices) to cover personal expenses or books.

III. The Evaluation Process: Understanding Need Analysis

UChicago requires both the FAFSA and the CSS Profile. They use these tools to perform a deep dive into a family’s true financial capacity.

FAFSA vs. CSS Profile

- FAFSA (Federal): Used to determine eligibility for federal aid (like Pell Grants). It is relatively simple and does not factor in home equity or certain business values.

- CSS Profile (Institutional): UChicago uses this to determine its own “Institutional EFC.” It is much more detailed and looks at assets like home equity, non-custodial parent information, and business valuations.

The Importance of Asset Reporting

UChicago considers “wealth” (savings, investments, and non-retirement assets) in addition to annual income. However, it is important to note that retirement accounts (like 401k or IRA) are generally excluded from these calculations.

Addressing Special Circumstances

If your financial situation changes—due to job loss, high medical expenses, or business fluctuations—after you have submitted your application, you should contact the UChicago Financial Aid Office immediately. They have the “professional judgment” to adjust your aid package based on these individual hardships.

IV. Annual Renewal and Outside Scholarships

1. Yearly Re-application

Financial aid is not a “one-time” deal. Families must re-submit the FAFSA and CSS Profile every year. As long as your financial situation remains relatively stable, your aid will remain consistent. If your income increases significantly, your grant amount may decrease accordingly.

2. Handling Outside Scholarships

If a student receives a scholarship from a private foundation or local organization, UChicago applies it in a student-friendly way. Typically, outside aid is used first to reduce the “self-help” portion of the package (Work-Study or loans) before it reduces the UChicago Grant.

V. Application Steps and Deadlines

The financial aid process is document-intensive. Accuracy and timeliness are paramount.

- FAFSA: Essential for all federal aid eligibility.

- CSS Profile: Required for UChicago’s institutional grants. (Note: Non-custodial parents must often submit their own profile).

- Tax Documents: UChicago verifies all information via the IDOC (Institutional Documentation Service). You will need to upload federal tax returns, W-2s, and relevant schedules.

Expert Tip: Financial aid deadlines are often earlier than you expect. Incomplete or late documentation is the most common reason for a delay in receiving an aid package.

Final Thoughts

The University of Chicago offers one of the most generous and student-friendly financial aid models in the world. Their Need-Blind policy and Full Need Met guarantee ensure that a UChicago education is accessible to any talented student, regardless of their family’s bank account.

Do not let the “sticker price” of a prestigious private university deter your child from applying. UChicago invests hundreds of millions of dollars annually to ensure that financial barriers do not stand in the way of academic excellence.

If you find the FAFSA or CSS Profile daunting, please do not hesitate to reach out to the university’s financial aid office or an expert for guidance.

Interested in learning more about the college admissions and financial aid process?

- Website: www.eliteprep.com/suwanee

- Tel: 470.253.1004

- Email: andy.lee@eliteprep.com

- YouTube: @andyssamTV

Andy Lee | Elite Prep Suwanee powered by Elite Open School

1291 Old Peachtree Rd, NW #127,

Suwanee GA, 33024