The Ultimate Guide for Parents: Unlocking Generous Financial Aid at Johns Hopkins University

Hello, Today, I want to provide you with a detailed look at the financial aid system at Johns Hopkins University (JHU), a world-renowned institution for pre-med, engineering, and international relations.

I have met countless parents over the years who lose sleep worrying about the staggering annual cost of attending a prestigious private university—often exceeding $100,000. Many prematurely assume, “Johns Hopkins is a private school; it must be too expensive for our family,” and hesitate even to let their child apply.

However, let me start with the conclusion: Johns Hopkins is currently one of the most transformative and generous institutions in the U.S. when it comes to financial aid.

Thanks to its recently expanded and groundbreaking, income-tiered tuition-free policy (Johns Hopkins Tuition Promise), JHU has opened a wide door of opportunity. For many middle-class families, JHU is now significantly more affordable than even a state university.

In this guide, we will thoroughly cover JHU’s admissions and cost structure, clarify its Need-Blind vs. Need-Aware policy, detail the new income-based benefits, review the required application documents, and illustrate the aid packages with real-world family scenarios to ease your worries.

If you read through to the end, you will gain the confidence that you do not have to let financial constraints limit your child’s educational dreams.

1. Johns Hopkins Admissions and Cost Overview

Let’s begin by transparently addressing the “sticker price” that most concerns parents.

For the 2025–2026 academic year, the estimated Total Cost of Attendance (COA) at Johns Hopkins is approximately $92,000 per year (around 120 million Korean Won).

This comprehensive figure includes about $66,670 for Tuition, approximately $21,000 for Housing and Dining (Room & Board), and additional amounts for books, personal expenses, and transportation.

This number alone can be intimidating. However, remember that this is the list price (Sticker Price). The amount the majority of students actually pay—the Net Price—is significantly lower.

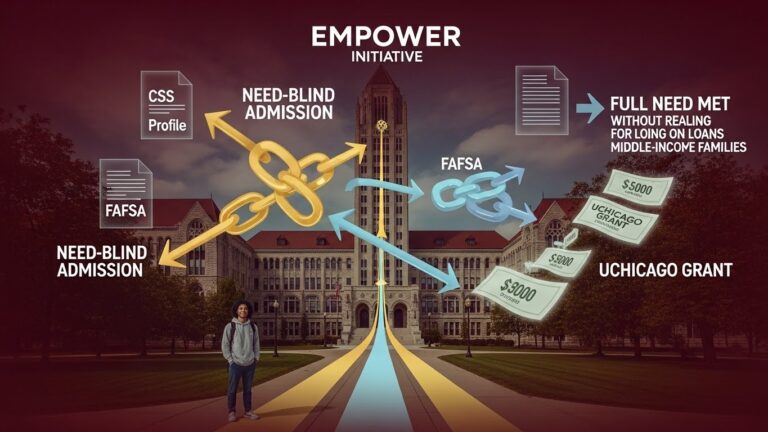

Need-Blind vs. Need-Aware: Does Aid Affect Admission?

Are you concerned that applying for financial aid will negatively affect your child’s chance of admission? The answer depends on your child’s citizenship status.

- U.S. Citizens and Permanent Residents (Domestic Applicants):Need-Blind

- A student’s application for financial aid is never considered in the admissions decision. You can apply for aid with confidence; financial need will not lead to a denial.

- International Students:Need-Aware

- For international applicants, financial circumstances are a factor considered during the admissions review. This means that if two international students have similar academic profiles, the one who does not require financial aid may have a slight advantage.

- Crucially, once admitted, JHU guarantees to meet 100% of the demonstrated financial need for all students, regardless of nationality.

2. The Heart of JHU Financial Aid: The “No-Loan” and “Tuition Promise” Support

The historic transformation of Johns Hopkins’ financial policy began with a monumental gift from alumnus Michael Bloomberg. This endowment allowed JHU to establish a financial aid system that rivals—and in some ways exceeds—that of the Ivy League schools.

Three Core Policies

- 100% Demonstrated Need Met (Full Need Met): JHU promises to cover 100% of the difference between the Cost of Attendance and what your family is expected to contribute (SAI/EFC).

- No-Loan Policy (Debt-Free Graduation): The financial aid package does not include any student loans that must be repaid later. Aid is offered entirely through scholarships and grants (gift aid) that do not have to be paid back. This allows students to graduate debt-free.

- The New Income-Tiered Tuition Promise (The Tuition Promise):This is the most critical element.

- Families with Annual Income up to $100,000 (approx. 130 million KRW): Tuition + Housing + Dining + Fees are fully covered. (Parent Contribution is $0)

- Families with Annual Income up to $200,000 (approx. 270 million KRW): Full Tuition is covered. (Parents are responsible only for Housing, Dining, and personal expenses.)

- Expert Insight: Very few universities in the United States offer full tuition coverage to middle-to-upper-middle-class families earning up to $200,000. This is a massive financial relief for middle-class parents.

3. Financial Aid Application Process and Required Documents

These exceptional benefits must be applied for to be received. Meeting the deadlines is crucial.

Required Documentation

- U.S. Citizens/Permanent Residents (Domestic Applicants):

- FAFSA (Free Application for Federal Student Aid): The federal application. JHU’s FAFSA School Code is E00473 (or the old 002077; always confirm on the school’s website).

- CSS Profile: The private college financial statement. Complete this through the College Board; JHU’s CSS Profile Code is 5332.

- IDOC: This system is used to upload supporting documents, such as parent and student Tax Returns and W-2 forms.

- International Students:

- CSS Profile: International students cannot file the FAFSA, making the CSS Profile the most important document. (Code: 5332)

- Certificate of Finances (COF): An additional institutional form required for international students.

- Parent Income Documentation: If you have Korean income, translated documents such as the Certificate of Income (소득금액증명원) or Withholding Tax Receipts (원천징수영수증) must be submitted.

Deadlines

- Early Decision I: Typically around November 15th

- Early Decision II / Regular Decision: Typically in early to mid-January (usually between January 2nd and 15th)

- Note: JHU often does not allow students to apply for need-based aid after they have been admitted. Therefore, you must apply for financial aid concurrently with your admissions application.

4. How is the Financial Aid Amount Determined? (Calculation Method)

You are likely wondering, “How much aid will our family receive?” The basic formula is as follows:

Cost of Attendance (COA) – Student Aid Index (SAI) / Expected Family Contribution (EFC) = Financial Need

- Expected Family Contribution (EFC): This amount is calculated by comprehensively reviewing parent income, assets (savings, investments, real estate), family size, number of children currently in college, and living expenses.

- Johns Hopkins covers this entire ‘Financial Need’ amount using institutional scholarships and grants (JHU Grant).

Estimating Your Net Price (Net Price Calculator)

We highly recommend using the ‘MyinTuition’ or ‘Net Price Calculator’ available on the JHU admissions website. By inputting basic financial information, you can get an estimated aid package in about five minutes.

5. Need-Based vs. Merit-Based: Are Merit Scholarships Available?

Many Ivy League schools do not offer Merit Scholarships (scholarships based on academic excellence). However, Johns Hopkins does offer Merit-Based aid.

- Need-Based Aid: Support based on financial need (accounting for over 90% of all aid provided).

- Merit-Based Aid: Examples include the prestigious Hodson Trust Scholarship and the Westgate Scholarship. In most cases, applicants are automatically considered for these scholarships simply by submitting their admissions application, with no separate application required.

- Expert Insight: Merit scholarships at JHU are highly competitive and awarded to only a small fraction of students. Therefore, parents should prioritize a strategy for securing Need-Based aid rather than relying on the long-shot chance of receiving a merit scholarship.

6. Financial Aid Outcomes through Hypothetical Scenarios

To aid your understanding, let’s look at three hypothetical families based on the 2025–2026 policy.

Scenario 1: Annual Income $90,000 (approx. 120 million KRW) – 4-person family, moderate assets

- Outcome: Parent Contribution is $0

- Under JHU’s new policy, this family falls into the $100k or less income bracket. JHU covers not just tuition, but also housing, dining, and other expenses. The student attends college for free.

Scenario 2: Annual Income $180,000 (approx. 240 million KRW) – 4-person family, middle-class

- Outcome: Full Tuition (approx. $66,670) is covered.

- This family falls into the $200k or less income bracket. Parents do not pay tuition and are only responsible for housing and dining (approx. $21,000).

- The actual cost is often lower than sending a student to a state university as an out-of-state or international student.

Scenario 3: Annual Income $300,000 (approx. 400 million KRW) – High-income professional, 2 children in college

- Outcome: Potential for Partial Aid

- Even with high income, families with two or more children simultaneously attending college may qualify for partial aid after the CSS Profile analysis. Do not assume you will receive nothing; it is always worth applying.

7. Key Takeaways for Parents (Expert’s Note)

Finally, here are the essential points that parents considering Johns Hopkins should keep in mind.

- “It’s too expensive to attend” is outdated thinking.

- For families with an annual income of $200,000 (approx. 270 million KRW) or less, Johns Hopkins is one of the most affordable elite universities in the U.S. Do not miss the ‘Full Tuition Coverage’ policy.

- If you are a U.S. Citizen/Permanent Resident, apply regardless (Need-blind).

- It will not negatively affect the admission decision. Do not make the mistake of forfeiting tens of thousands of dollars in aid by failing to apply.

- International Students require a strategy.

- Applying for financial aid can slightly impact the admission rate. However, if your family cannot afford the full cost, apply boldly. If admitted, you will receive 100% of your demonstrated need. It is better than being admitted without aid and having to decline the offer due to cost.

- Deadlines are non-negotiable.

- Late documents can result in losing aid. Be sure to prepare and submit tax documents via IDOC well in advance, as this process takes time.

- You must reapply annually.

- Financial aid is renewed yearly. As long as your income does not drastically increase, you can expect similar support throughout the four years.

Conclusion

Johns Hopkins University is firmly committed to the philosophy that “Talent should not be constrained by financial barriers.” You must look beyond the $92,000 price tag to see the ‘opportunity for generous financial support’ hidden behind it.

If your child has the potential to attend Johns Hopkins, entrust the financial matters to the university and experts, and wholeheartedly support your child’s endeavor. With meticulous preparation and the right strategy, Johns Hopkins can potentially become “the most economical choice” for your family.

Thank you.

If you would like more detailed guidance on education planning, financial aid, or admissions strategy, please click here or contact us at: www.eliteprep.com/contact-us

We will provide personalized consulting and recommend tailored strategies that best fit your student’s individual needs.

Andy Lee / Elite Prep Suwanee powered by Elite Open School

1291 Old Peachtree Rd, NW #127

Suwanee, GA 30024

Elite Prep Suwanee Website

Elite Open High School Website

email: andy.lee@eliteprep.com

Tel & text: 470.253.1004

🎥 www.youtube.com/@andyssamTV